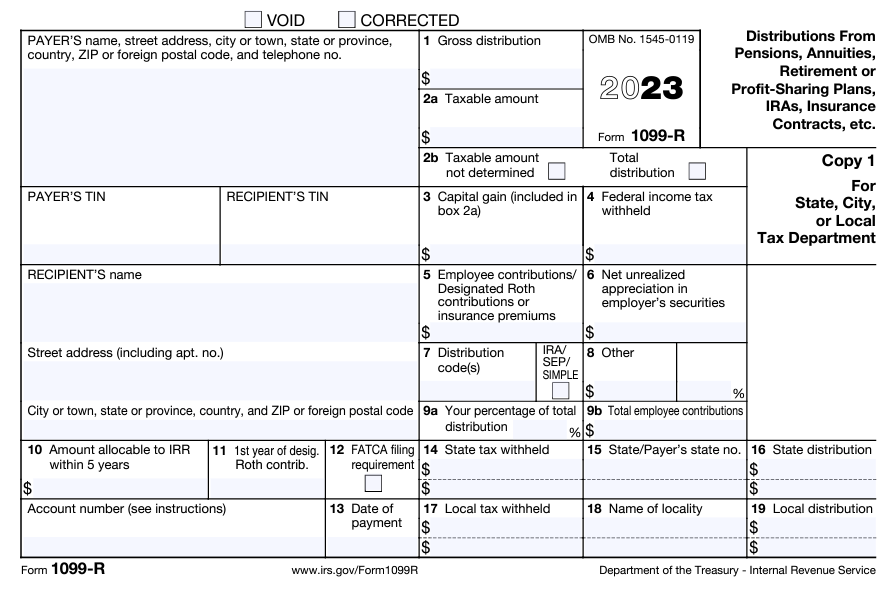

Form 1099-R

Form 1099-R for Annuity Distribution

Form 1099-R is used to report distributions from accounts such as pensions, annuities, retirement plans, IRA's, and insurance contracts. If you received a Form 1099-R from us, you received a reportable transaction from an annuity contract. You may have received more than one Form 1099-R if you had reportable transactions from multiple contracts, transactions involving multiple distribution codes, or you received transactions when living in different tax residency states. The following is a list of transactions on your annuity contract that may be reported on a 1099-R:

Important 1099-R Information:

Recipient ID#: For your protection, this form may show only the last four digits of your SSN, ITIN, ATIN, or EIN. However, your complete identification number has been reported to the IRS.

Account Number: Your annuity contract number.

Box 1: Reports the total distribution from the annuity, and may or may not be the taxable amount.

Box 2a: Generally reports the taxable amount. There are multiple reasons this may be left blank, including:

-

Distribution is from a Roth IRA

-

Distribution is from an annuity contract that is not in an IRA or qualified account

-

Distribution was a 1035 exchange

Box 4: Reports federal income tax withheld from your distribution.

Box 7: Provides a distribution code that indicates the nature of the distribution, and will provide information to assist in determining how the distribution needs to be reported on your tax return. A list of distribution codes is provided in the Box 7 paragraph on the reverse side of your 1099-R document.

Box 14-15: Reports any state tax withheld and the taxing jurisdiction for the recipient.

Eagle Life Insurance Company® does not offer legal, investment, or tax advice. Please consult a qualified professional.