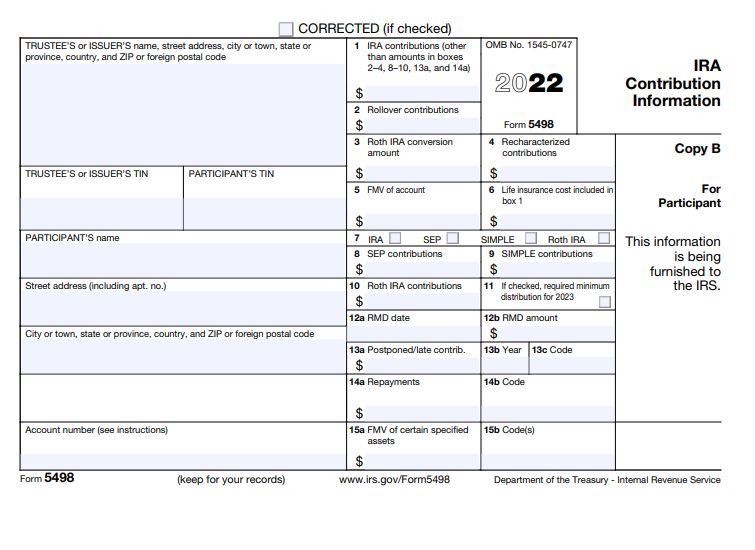

Form 5498 for IRA Accounts

Form 5498 is a statement summarizing IRA contributions, recharacterizations, and conversions reported to the IRS.

Selected Form 5498 Information:

Participant ID#: For your protection, this form may show only the last four digits of your SSN, ITIN, ATIN, or EIN. However, your complete identification number has been reported to the IRS.

Account Number: Your annuity contract number.

Box 1: Shows traditional IRA contributions made in the reporting tax year and, if designated, through the due date of the tax return not including extensions.

Box 2: Shows any rollover, including a direct rollover to a traditional IRA or Roth IRA. It does not show any amounts you converted from your traditional IRA, SEP IRA, or SIMPLE IRA to a Roth IRA. They are shown in box 3. See the Form 1040 instructions for information on how to report rollovers.

Box 3: Shows the amount converted from a traditional IRA, SEP IRA, or SIMPLE IRA to a Roth IRA for the year.

Box 4: Shows amounts recharacterized from transferring any part of the contribution (plus earnings) from one type of IRA to another.

Box 5: Shows the fair market value of your account at year end.

Box 7: May show the kind of IRA reported on this Form 5498.

Box 8: Shows SEP contributions made during the reporting tax year.

Box 9: Shows SIMPLE contributions made during the reporting tax year.

Box 10: Shows Roth IRA contributions made in the reporting tax year and, if designated, through the due date of the tax return not including extensions.

Eagle Life Insurance Company® does not offer legal, investment, or tax advice. Please consult a qualified professional.