Security for today. Options for tomorrow.

Eagle Guaranteed Flex 5

The Eagle Guaranteed Flex 5 fixed index annuity (FIA) combines the safety of fixed-rate returns with the potential upside of index-linked strategies across five flexible crediting options. With full principal protection, annual reallocation abilities, and added flexibility for health-related events, it’s designed to help you grow your retirement savings — on your terms and at your pace. Not available in California.

Accumulation with built-in protection

Customize your approach with five flexible crediting strategies

Eagle Guaranteed Flex 5 gives you the flexibility to shape your growth strategy — whether you prefer steady, predictable returns or dynamic market-linked opportunities. Choose from five crediting strategies:

Pursue growth in any market while protecting your principal

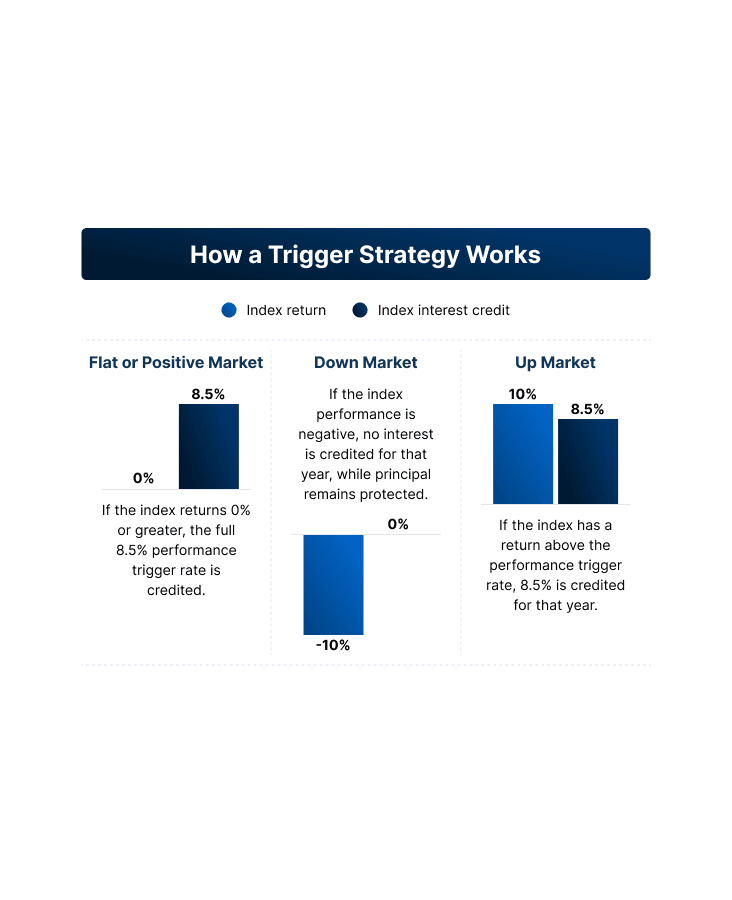

The annuity’s performance trigger and par rate for term strategies work together to provide dependable opportunities for accumulation, even when market gains are modest.

Access your money when circumstances change

The Enhanced Benefit Rider is included at no extra cost for issue ages 75 and under and activates benefits for terminal illness or extended nursing care. After only one year, you may take up to 100% of your contract value in these situations, ensuring access when it's needed most.

Product materials

Annuity contract issued under form series ICC23 E-BASE-IDX, ICC23 E-IDX-C-5, ICC23 E-E-F-RL, ICC23 E-E-BPT, ICC21 E-E-PTP-C, ICC21 E-E-PTP-PR, ICC17 E-R-MVA, ICC20 E-R-EBR and state variations thereof. Availability may vary by state. Guarantees are based on the financial strength and claims paying ability of the issuing company. Eagle Life is a wholly owned subsidiary of American Equity Investment Life Insurance Company®. Possible interest credits for money allocated to an index-linked crediting strategy are based upon performance of the specific index; however, fixed index annuities are not an investment, but an insurance product, and do not directly invest in the stock market or the index itself.

Surrender charges may apply to excess withdrawals that exceed 10% annual free withdrawal available under the contract. Contract owners may be subject to a 10% federal penalty if withdrawals are made before age 59 1/2.

This material is for informational purposes only, and is not a recommendation to buy, sell, hold or rollover any asset. It does not take into account the specific financial circumstances, investment objectives, risk tolerance, or need of any specific person. In providing this information Eagle Life Insurance Company is not acting as your fiduciary as defined by the Department of Labor. Eagle Life does not offer legal, investment or tax advice or make recommendations regarding insurance or investment products. Each client has specific needs that should be discussed with a qualified legal or tax advisor.

The S&P 500® is a product of S&P Dow Jones Indices LLC (“SPDJI”) and has been licensed for use by Eagle Life Insurance Company (“EL”). Standard & Poor’s® and S&P® are registered trademarks of Standard & Poor’s Financial Services LLC (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”). These trademarks have been licensed to SPDJI and sublicensed for certain purposes by EL. EL's products are not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, or their respective affiliates, and such parties make no representations regarding the advisability of investing in such product(s) and have no liability for any errors, omissions, or interruptions of the S&P.

The Invesco Dynamic Growth Index (the “Index”) is owned by Invesco Indexing, LLC ("Licensor"). Licensor has licensed the Index to Eagle Life Insurance Company to be used as a component of certain fixed index annuity products (the “Products”). The Index may be calculated by a third party or contain third-party data, each third-party provider and Licensor are collectively “Licensor Parties”. The Products are not sponsored, operated, endorsed, sold or promoted by Licensor Parties. The Index, the proprietary data therein, and related trademarks, are intellectual property licensed from Licensor, and may not be copied, used, or distributed without Licensor’s prior written approval. The Products have not been passed on as to their legality or suitability, and are not regulated, issued, endorsed, sold, guaranteed, or promoted by Licensor Parties. Licensor Parties make no express or implied warranties, and hereby expressly disclaims all warranties of merchantability or fitness for a particular purpose with respect to the Index or any data included therein. Without limiting any of the foregoing, in no event shall Licensor Parties have any liability for any special, punitive, indirect, or consequential damages (including lost profits), even if notified of the possibility of such damages.

The Products have not been passed on as to their legality or suitability, and are not regulated, issued, endorsed, sold, guaranteed, or promoted by Licensor Parties. Licensor Parties make no express or implied warranties, and hereby expressly disclaims all warranties of merchantability or fitness for a particular purpose with respect to the Index or any data included therein. Without limiting any of the foregoing, in no event shall Licensor Parties have any liability for any special, punitive, indirect, or consequential damages (including lost profits), even if notified of the possibility of such damages.